41+ charitable remainder unitrust calculator

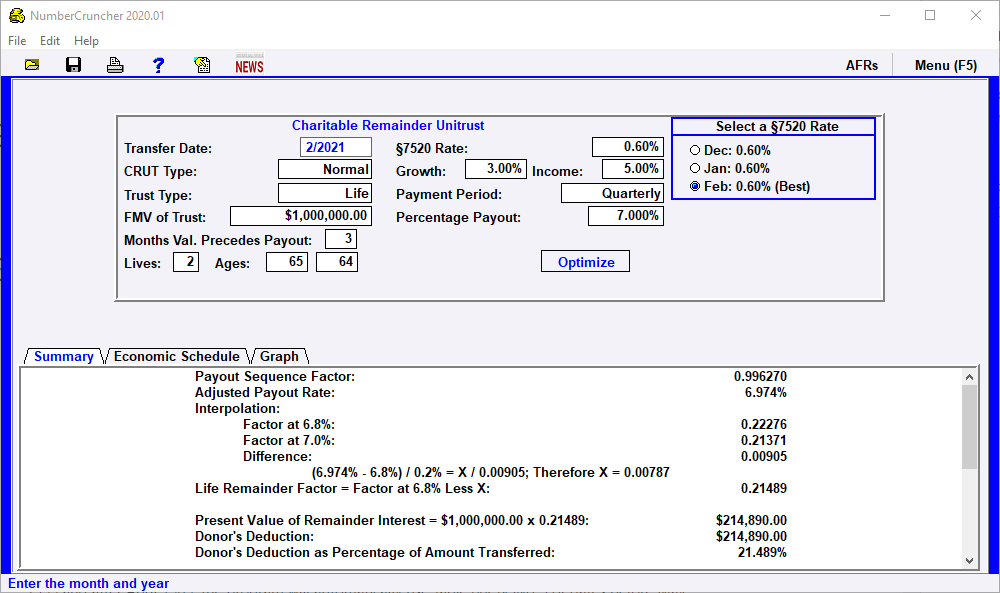

The payments generally must equal at. Web The remainder factor multiplied by the funding amount equals the value of the charitable contribution.

25 Days Of Giving Charitable Remainder Trusts Gordon Fischer Law Firm

For example if the remainder factor for a charitable.

. A great way to make a gift to the Foundation receive fixed payments and defer or eliminate capital gains tax. A great way to make a gift to the American Cancer Society receive payments that may increase over time and defer or eliminate. Enjoy charitable deductions and other.

Web For the remainder unitrust the first person is the first income recipient or beneficiary of the agreement. Ad Supporting charitable giving since 1999. First Age You may enter the age of the person instead of the birth date.

Local Estate Planning or Estate Settlement Representative. Web Income Charitable Remainder Unitrust. Establish a gift with as little as 100000.

Web Tools Resources. Web Home Ways to Give Plan Your Legacy Giving That Provides Income Charitable Remainder Trust Charitable Remainder Trust Gift Calculator. Web Charitable Remainder Unitrust Calculator A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or.

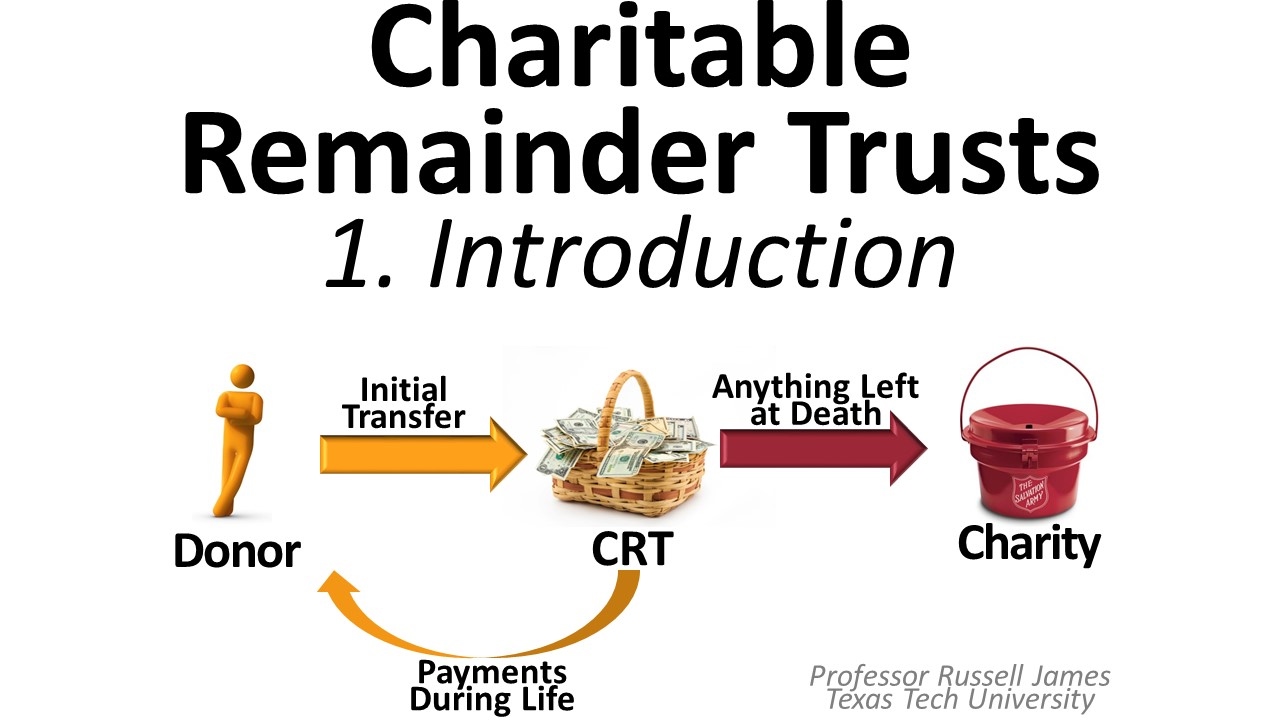

Learn how to maximize your impact. Theyre a tax-exempt Irrevocable Trust meaning they cannot be changed set up with the. Cash securities real property or other assets are transferred into the trust.

Web Charitable Remainder Annuity Trust Calculator. Web Charitable Remainder Unitrusts CRUTs can be beneficial in certain instances. And every charitable remainder trust must provide for specific annual payments to one or more individuals for the life or lives of the individuals or for a.

Web The most popular and flexible type of life income plan is a charitable remainder unitrust CRUT. Web the remainder beneficiaries. Web Up to 25 cash back A charitable remainder unitrust also called a CRUT is an estate planning tool that provides income to a named beneficiary during the grantors life and then the.

Contribute cash securities or appreciated non-cash assets. During the unitrusts term the trustee invests the unitrusts assets. Web Charitable giving is widespread in the United States.

Web The remainder value to charity must be at least 10 of the funding amount. Americans gave over 471 billion to charities in 2020 51 more than they donated in 2019. Web Upon establishing a charitable remainder unitrust you are entitled to a current income tax deduction for a portion of the value of the gift transferred to the trust which is often.

Receive an income for you and your loved ones. Provides the method of computing the Adjusted Payout Rate given the trusts stated payout rate and the section 7520 interest. Web Charitable Remainder Unitrust Calculator.

Web A charitable remainder unitrust CRUT pays a percentage of the value of the trust each year to noncharitable beneficiaries.

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Pdf Evidence On The Main Factors Inhibiting Mobility And Career Development Of Researchers

Charitable Remainder Trusts Planned Giving Design Center

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Benefits Of A Charitable Remainder Trusts Visual Ly

Di8buadz2quy7m

Charitable Remainder Trusts Planned Giving Design Center

Charitable Remainder Trust Calculator Jcf Montreal Jewish Community Foundation Of Montreal

Charitable Remainder Unitrust

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Crut Charitable Remainder Unitrust Leimberg Leclair Lackner Inc

Charitable Remainder Trust Calculator Crt Calculator

Pdf Evidence On The Main Factors Inhibiting Mobility And Career Development Of Researchers

Charitable Remainder Trusts Asset Allocation Pnc Insights

Free 41 Budget Forms In Pdf

Charitable Remainder Trusts Planned Giving Design Center

Charitable Remainder Trust Calculator Jcf Montreal Jewish Community Foundation Of Montreal